Contents:

The broker specializes in contracts for difference , which it delivers through web-based and electronic proprietary trading platforms. As a market-maker broker, eToro lists a variable spread of 1 pip on the EUR/USD pair, which is higher than the average in the forex industry. However, traders mostly choose eToro for its social copy capabilities as opposed to its spreads.

Brown & Sons traded foreign currencies around 1850 and was a leading currency trader in the USA. Do Espírito Santo de Silva (Banco Espírito Santo) applied for and was given permission to engage in a foreign exchange trading business. As such, FXCM does not make any warranties regarding the services provided by the third parties. Clients are not required to sign up with the third parties FXCM offers. Instead clients are encouraged to find a VPS provider that best meets their needs.

The Authority warns that if a london forex brokers is not listed on its register, “it’s probably a scam”. Regulation is essential for protecting your money and ensuring a fair and transparent trading experience. The StockBrokers.com best online brokers 2023 review, our 13th annual, took three months to complete and produced over 40,000 words of research.

Best forex brokers in the United Kingdom in 2023

All these developed countries already have fully convertible capital accounts. Some governments of emerging markets do not allow foreign exchange derivative products on their exchanges because they have capital controls. Countries such as South Korea, South Africa, and India have established currency futures exchanges, despite having some capital controls. U.S. President, Richard Nixon is credited with ending the Bretton Woods Accord and fixed rates of exchange, eventually resulting in a free-floating currency system.

- FXCM intends to apply similar changes to MT4 accounts in the future, with some already in action for part of the available instruments.

- When you sign up, you will have access to a dedicated account officer who will work with you to help you better understand your needs and how XTB works.

- She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology.

- Whether that’s through a website Q&A section or suite videos on YouTube or a help desk.

Established names like IG Group score well as a broker for those that are new to trading or have a small deposit. Both CMC Markets and Spreadex can accommodate smaller deposits and new forex traders. Both of these businesses have straightforward intuitive trading platforms.

Saxo Bank – Top UK Forex Trading Platform for Active FX Traders

Trading on eToro occurs in USD, so a currency conversion fee will apply if you deposit or withdraw in a currency other than USD. Withdrawals incur a fee of US$5, and the minimum withdrawal amount is US$50. For UK customers, eToro offers an eToro Money app which allows you to convert your GBP to USD free of charge, thereby reducing your foreign exchange costs. XStation by XTB is a powerful trading software available on iOS, Android and desktop devices and suitable for both beginners and advanced forex traders. The xStation forex trading apps give you access to comprehensive charting and risk management tools.

There is no such thing as a free lunch they say, and that rings true in trading. Brokers have costs and they need to meet those costs somehow, whether that is through the spread and/or commissions or trading against their clients via B-book. Where brokerage services are offered free, for example, in trading US equities, the broker is paid by a market maker or high-frequency trader for their client’s order flow. The adage that if something looks too good to be true then it probably is, remains good advice. For forex traders, who want manual execution, the cTrader forex trading platform offers good functionality where you can trade directly from the charts, as well as drag and drop stops and limits.

Dayana has also been a guest expert on «Today» and Good Morning America.

Can I trade with a U.K. forex broker if I reside in the EU?

The pound is also one of the few currencies that is valued more than the USD, and the UK is one of the major destinations for raising capital. As a solid alternative to the USD, the pound is poised to remain a preeminent global currency for quite some time. «Triennial Central Bank Survey of foreign exchange and OTC derivatives markets in 2022». Gregory Millman reports on an opposing view, comparing speculators to «vigilantes» who simply help «enforce» international agreements and anticipate the effects of basic economic «laws» in order to profit.

Prior to the First World War, there was a much more limited control of international trade. Motivated by the onset of war, countries abandoned the gold standard monetary system. Money-changers were living in the Holy Land in the times of the Talmudic writings .

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs.

Often, a forex broker will charge a small fee to the client to roll-over the expiring transaction into a new identical transaction for a continuation of the trade. Foreign exchange is traded in an over-the-counter market where brokers/dealers negotiate directly with one another, so there is no central exchange or clearing house. The biggest geographic trading center is the United Kingdom, primarily London. In April 2022, trading in the United Kingdom accounted for 38.1% of the total, making it by far the most important center for foreign exchange trading in the world.

We’d recommend trying out eToro due to its suitability for social trading, ease of use, and integration of advanced trading tools. Unregulated brokers are usually notorious for outright theft like conversion of funds. Learning to trade forex or any commodity requires time, patience, and a high level of commitment. For instance, eToro is regulated in two tier-1 jurisdictions, while IG, one of the best low-risk traders, is listed on the London Stock Exchange and regulated by the FCA and Federal Financial Supervisory Authority . Forex.com gives you access to a variety of product offerings from forex to equities, indices, commodities, ETFs, cryptos, industry sectors, and futures .

As a good rule of thumb, it’s best to create an account with a well-reputed broker boasting a clean-enough track record. Forex brokers are worth the while if you want to trade forex as the company plays the all-important role of executing your orders. A broker can either act internally as the principal to your forex trade or send your currency orders to another market and act as your agent.

The plan was to reduce client dependency on traditional financial institutions and make trading accessible to everyone. ALL INVESTING INVOLVES RISK. Investing, Derivatives, Spread betting and CFD trading carry a high level of risk to your capital and can result in losses that exceed your initial deposit. They may not be suitable for everyone, so please ensure that you fully understand the risks involved. Option prices are driven by other factors, including interest rates, volatility, or the propensity for rapid price change in the underlying instruments, and they are sensitive to changes in key ratios used in pricing models.

Market psychology

Spread bets are also likely to have a fixed expiry, whether that’s daily, weekly or quarterly. While FX trades, which are effectively CFD trades, have no fixed expiry unless you are trading a currency future or option, rather than the rolling spot contract. The obvious disadvantage is that it is possible to lose money quickly and losses are multiplied significantly.

HSBC Fires London Trader as Crackdown on Client Messaging … – Bloomberg

HSBC Fires London Trader as Crackdown on Client Messaging ….

Posted: Wed, 15 Jun 2022 07:00:00 GMT [source]

These companies differ from Money Transfer/Remittance Companies in that they generally offer higher-value services. Around 25% of currency transfers/payments in India are made via non-bank Foreign Exchange Companies. Most of these companies use the USP of better exchange rates than the banks. They are regulated by FEDAI and any transaction in foreign Exchange is governed by the Foreign Exchange Management Act, 1999 .

Non-trading fees at the best UK online forex brokers

We have ranked Pepperstone as the best broker for trading USDJPY based on their spreads of 0.25 pips. With CFD FX brokers and spread betting commission is generally built into the price making it easier to calculate P&L. Platforms like Currenex offer a form of DMA, whereby the platform aggregates orders from multiple brokers showing liquidity depth. Forex brokers like Saxo Markets and Interactive Brokers offer DMA currency trading through currency futures. There are a couple of FX ETFs to trade that track GBP, EUR and USD, but there are no OTC options markets, nor can you trade on exchange futures with DMA. They also have 12 “Forex Indices” which are baskets of currency pairs that track the same base currency.

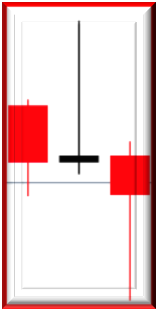

Within the interbank market, spreads, which are the difference between the bid and ask prices, are razor sharp and not known to players outside the inner circle. The difference between the bid and ask prices widens (for example from 0 to 1 pip to 1–2 pips for currencies such as the EUR) as you go down the levels of access. If a trader can guarantee large numbers of transactions for large amounts, they can demand a smaller difference between the bid and ask price, which is referred to as a better spread.

The levels of access that make up the foreign exchange market are determined by the size of the «line» . The top-tier interbank market accounts for 51% of all transactions. From there, smaller banks, followed by large multi-national corporations , large hedge funds, and even some of the retail market makers. Central banks also participate in the foreign exchange market to align currencies to their economic needs.

10 Best Forex Brokers in South Africa – Finance Magnates

10 Best Forex Brokers in South Africa.

Posted: Mon, 22 Aug 2022 07:00:00 GMT [source]

You should be extra careful when choosing the best forex broker as not all come with the same features. Most of the brokers on our list have multiple educational resources that furnish traders with priceless information on the dos and don’ts of trading. Some platforms are better suited for experienced traders due to their wealth of features, while others work well for beginners due to their simplicity.

CMC Group Launches New Stock Trading Platform – Finance Magnates

CMC Group Launches New Stock Trading Platform.

Posted: Mon, 03 Oct 2022 07:00:00 GMT [source]

Each tool has integrated buy and sell buttons so traders can act instantly upon the information presented. Headquartered in London and FCA regulated, FxPro is one of the largest brokers in the world and has no dealing desk, which means it never trades against its clients. In recent years, a few fraudulent firms with names and websites similar to FxPro’s have been shut down by the FCA, so UK traders should always make sure they are trading with the correct firm. IG Markets is regulated by the UK’s FCA and 16 other authorities around the world. FCA regulation means that all IG Markets clients have negative balance protection, so they can never lose more money than they have in their trading account.

Pepperstone offers uncomplicated access to the markets, which allows clients to focus on the complicated task of successfully trading the markets. Pepperstone is ideally suited to traders who want a manageable range of low-cost offerings, multiple choices of user interfaces and account types, and efficient customer support. The Pepperstone platform is suitable for both beginners and advanced traders. It is entirely free to open an account with Pepperstone, and all registered users gain access to a free demo account which you can use to practise forex trading until you become confident.

In addition they are https://trading-market.org/d by speculators who hope to capitalize on their expectations of exchange rate movements. During the 1920s, the Kleinwort family were known as the leaders of the foreign exchange market, while Japheth, Montagu & Co. and Seligman still warrant recognition as significant FX traders. By 1928, Forex trade was integral to the financial functioning of the city. Continental exchange controls, plus other factors in Europe and Latin America, hampered any attempt at wholesale prosperity from trade for those of 1930s London. During the 15th century, the Medici family were required to open banks at foreign locations in order to exchange currencies to act on behalf of textile merchants. During the 17th century, Amsterdam maintained an active Forex market.